Cal Maritime is committed to making a quality education accessible to all students. We strongly encourage every student - regardless of family income - to apply for financial aid. While it is your responsibility to complete the required applications and documentation, our Financial Aid Office is here to support you every step of the way.

Contact & Resources

Cal Maritime offers a variety of financial aid programs to students needing assistance in financing their education. Funds are made available by the U.S. Department of Education, the State of California, private lending institutions and, with support from our philanthropic donors, Cal Maritime directly. Types of financial assistance include scholarships, grants, loans, and employment opportunities.

Applying for Financial Aid

To apply for financial aid, students should submit a Free Application for Federal Student Aid (FAFSA). The FAFSA is the basic application required for most federal, state, and institutional financial aid. Applications can be submitted beginning October 1 before the start of the academic year (i.e., October 1, 2025, for the 2026-2027 school year). You can apply online at http://www.studentaid.gov. The priority filing deadline to apply is March 2.

Students who meet CA AB540 requirements and are unable to apply via the FAFSA can complete the California Dream Act Application (CADAA) at https://dream.csac.ca.gov/landing.

The CADAA is used to apply for state financial aid, including Cal Grant and the Middle Class Scholarship as well as institutional aid such as the State University Grant (SUG).

Scholarships

Cal Maritime receives annual scholarship funds from individuals, corporations, foundations, and professional associations. The California State University Maritime Academy Foundation manages a number of scholarship endowments, many of them named in memory of distinguished individuals associated with Cal Maritime.

Continuing students may apply on-line for California State University Maritime Academy Foundation scholarships in the spring. Applicants are chosen based on merit (cumulative GPA), need (the student aid index (SAI) from the FAFSA application), leadership, and community service. There may be other determining factors, depending on the donor’s wishes. Students are notified before the end of the spring semester of their scholarship award for the next academic year.

Grants

Federal Pell Grant Program

Pell Grants are federally funded available to students pursuing their first undergraduate degree. Grants are awarded based on a student’s aid index from the FAFSA and enrollment. Pell Grants are awarded assuming full-time enrollment. The award may be adjusted according to actual enrollment at the add/drop deadline for the term.

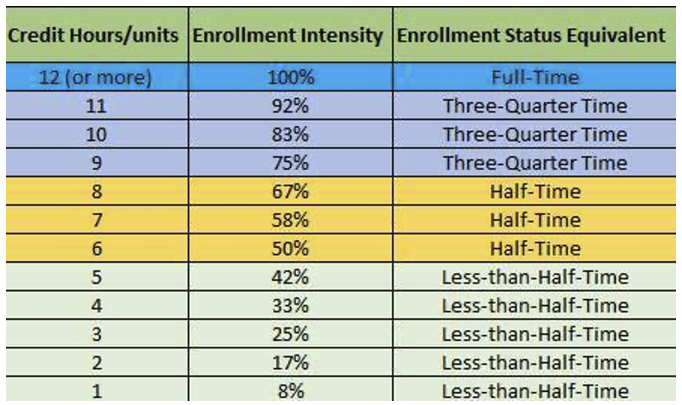

Beginning with 2024-2025, the Pell Grant disbursement amounts will now be calculated using Enrollment Intensity - which is a percentage value based on the number of credits a student is enrolled for during a term.

Federal Supplemental Educational Opportunity Grant Program (FSEOG)

SEOG Grants are federally funded, need-based awards available to students pursuing their first undergraduate degree who have exceptional financial need. Priority is given to Federal Pell Grant recipients and those who have completed their FAFSA by March 2. These funds are awarded directly by Cal Maritime and are limited to the total amount allocated to the college by the U.S. Department of Education.

Cal Grant A & B

The California Student Aid Commission (CSAC) awards these grants to California residents who have displayed academic achievement and financial need.

Cal Grant A provides need-based grant assistance to low- and middle-income students to offset tuition costs for high school graduates with at least a 3.0 GPA. Recipients must also meet financial requirements. These awards are limited to the total amount of the system-wide state tuition fees for full-time students.

Cal Grant B provides need-based grant assistance to high-potential students from low-income, disadvantaged families to help offset tuition/fee and other costs for high school graduates with at least a 2.0 GPA. Recipients must also meet financial requirements.

Students must apply for the Cal Grant by completing their FAFSA or CADAA by the March 2 deadline and submitting a GPA verification form. This grant is not available to students who have already received a baccalaureate degree.

Middle Class Scholarship (MCS)

The Middle Class Scholarship is administered by the California Student Aid Commission and provides an amount to help with college expenses for eligible California residents. Students apply for MCS by completing their FAFSA or CADAA by the March 2 deadline.

State University Grants

The State University Grant (SUG) provides need-based awards to cover the state tuition fees for eligible undergraduate students who are California residents or are otherwise determined as eligible. Priority is given to high-need students who have filed their FAFSA or CADAA by March 2 and who have an SAI of 3,250 or less. Students who have their state university fees paid with a Cal Grant or by another outside agency are not eligible to receive this award.

Loans

Federal Direct Student Loans, often referred to as Direct Loans, are loans provided by the U.S. Department of Education to eligible students and parents to help cover the costs of higher education.

These loans include Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans

Federal Direct Stafford Loans

A subsidized federal direct loan is a government-insured, long-term, low-interest loan for eligible undergraduate students. The federal government pays the interest on the loan while the student remains enrolled in college at least half-time or more. Repayment begins six months after graduation or separation.

An unsubsidized federal direct loan is a long-term, low-interest loan for eligible undergraduate and graduate students who generally do not qualify for other need-based financial assistance, or for students who need loan assistance beyond the maximums provided by the subsidized loan program. Students can pay the interest while in school, or defer payments until the loan goes into repayment.

Federal Plus Loan

A federal direct parent PLUS Loan is a government-insured, long-term, low-interest loan for eligible parents of dependent, undergraduate students who generally do not qualify for other financial assistance. Parents may borrow up to the total cost of their dependent student’s education minus any other aid for which the student is eligible.

PLUS loans have a fixed interest rate set on July 1 of each year. Repayment begins 60 days after the funds are fully disbursed, and the repayment term is 10 years. Parents have the option of deferring repayment on PLUS loans while the student is in school, and for a six-month grace period after the student graduates or drops below full-time enrollment.

Dependent students whose parents have been denied a PLUS loan may be eligible to apply for an additional unsubsidized loan.

To qualify for a PLUS loan, the parent must be a U.S. citizen or an eligible non-citizen, have a valid social security number, and pass a credit check.

Private Loans

In addition to the federal loan program, many lenders offer alternative educational loans. At Cal Maritime, we encourage you to look at the federal loans before you take out alternative or private loans.

Student Employment

For many students, employment is a supplement to borrowing. Students should attempt to establish a reasonable balance between their academic efforts and work schedules. Consequently, student employees may not work more than 20 hours per week except during periods when classes are not in session.

Federal Work Study Program

Federal Work-Study (FWS) students receive placement for student employment on campus. FWS is a need-based financial aid program that provides part-time employment for students. Federal Work-Study jobs assist students financially and may provide career-related work experience. Pay rates vary depending on job requirements and student skills. To receive priority consideration, complete the FAFSA by March 2 for the upcoming year.

Students who are interested in a FWS position must make sure they have been awarded FWS. If not, they must contact the Financial Aid Office to see if they are eligible.

Once it is determined that a student has been accepted into the FWS program, he or she will be provided with additional instructions for assistance in finding an on-campus job, and to complete the required paperwork.

Eligibility Requirements for Federal Financial Aid

Each Federal program has its own set of requirements governing the administration and receipt of funds from the program. These requirements are subject to change at any time.

In general, in order to receive financial aid at Cal Maritime, a student must:

- be a U.S. citizen or eligible non-citizen (or otherwise be eligible through CADAA for state aid only)

- be enrolled or accepted for enrollment as a regular matriculated student in a degree program

- be making Satisfactory Academic Progress

- not owe a refund on a federal grant or be in default on a federal education loan

- for state programs such as Cal Grant and State University Grant - be a California resident

Financial Aid Satisfactory Academic Progress

Federal regulations require students maintain Satisfactory Academic Progress (SAP) to remain eligible to receive financial assistance. The SAP policy governs eligibility for all federal and state financial aid programs. (Note: The SAP Policy for financial aid is separate, different but not any stricter from the CMA Academic Standing Policy, which pertains to eligibility to remain enrolled in courses at CMA).

There are two components required to maintain SAP: a qualitative measure, demonstrated by grade point average (GPA), and quantitative measure which include both a measurement of pace of progression towards a degree and a maximum timeframe for completion of a program of study.

SAP Standards Information

| Degree |

Minimum Cumulative GPA |

Minimum Cumulative Pace of Progress |

Maximum Time Frame of Aid Eligibility for Degree Completion |

| Undergraduate (1st Bachelors) |

2.0 |

66.67% |

150% of published degree length |

| Graduate Degree (Master’s) |

3.0 |

66.67% |

150% of published degree length |

SAP Evaluation Period

Financial Aid SAP will be evaluated at the end of the Spring semester once grades have been finalized and posted. Your SAP status is calculated using your entire academic record from all schools attended, even if you did not receive financial aid. Courses taken in the Summer, Fall, and Spring will be evaluated at the end of the next Spring semester.

Students will be notified via email to the @csum.edu email account on the outcome of their SAP status, this includes “meets” and “not meets” statuses.

SAP Disqualification

Students who fail to meet the SAP standards will be SAP disqualified and ineligible for Federal and State financial assistance. If during the SAP review process, it is determined a student will not be able to meet the quantitative measure (maximum timeframe) by graduation, the student will be ineligible for future financial assistance.

Appealing and Reinstatement of Financial Aid Eligibility

To regain eligibility for financial aid, students may submit an appeal in cases where there have been extenuating circumstances beyond the student’s control which prevented him/her from meeting SAP requirements. Examples include the death of a close relative, a serious injury, or an illness. There are three critical elements to filing a successful appeal:

- An explanation why the student failed to meet the academic the academic standards

- What has changed to ensure success in future coursework and;

- An academic plan (signed by an academic or major adviser) that demonstrates the student will be able to meet SAP standards within one year or by a specific point as defined by the plan.

Students who regain eligibility as a result of an appeal will be considered to be on Financial Aid Probation for the period of the plan. Students who fail to meet SAP standards (as defined by the academic plan) or does not follow the academic plan will be ineligible to receive financial aid. No further appeals will be granted unless the student can demonstrate there were extenuating circumstances beyond the student’s control which prevented meeting the academic plan. The circumstances must be different circumstances than those for which a prior appeal was granted.

Full SAP policy can be found here: SAP Policy

Continued Enrollment without Financial Aid

Students who are denied aid as a result of Financial Aid SAP policy may continue coursework at Cal Maritime without the benefit of federal or state or campus financial aid. It may be possible for students to receive loans and scholarships from private sources only.

Withdrawal from the California State University Maritime Academy

Courses from which a student withdraws prior to “last day to drop with no grade reported” do not count toward units attempted or completed. Courses dropped after “last day to drop with no grade reported” are counted as units attempted but not completed.

Financial aid recipients are obligated to remain enrolled and pass a certain number of units. Upon a financial aid recipient’s withdrawal from school prior to the end of the term, Cal Maritime is required by the federal government to calculate whether a return of financial aid funds is required. Students should refer to the Return Of Title IV Funds section below.

All financial aid recipients should speak to a financial aid counselor to discuss the impact of any proposed changes in enrollment such as dropping a course, repeating a course, or withdrawing from Cal Maritime as any of these changes may impact a student’s satisfactory academic progress and thus future eligibility for financial aid.

Return of Title IV Funds (Federal Requirement)

Federal Regulations, 34 CFR 668.22 require schools to calculate the amount of Federal financial aid earned by students who withdraw from an institution. This calculation, Return of Title IV Funds also known as R2T4, must be performed for students who follow the school’s formal withdrawal procedures and those who leave without formal notification, the “unofficial” withdrawals.

The purpose of R2T4 is to return to the federal financial aid programs any aid that is “unearned” by the student. These funds are returned first by the institution and second by the student/parent. The philosophy behind the order of return of funds is that since aid is disbursed to meet institutional charges, the campus had control over these funds. Funds disbursed to the student to meet other educationally-related expenses are not under the control of the institution.

Upon a financial aid recipient’s withdrawal, Cal Maritime is required by the federal government to calculate, collect, and return a portion of federal financial aid grant or loan funds received by the student if the student has not completed 60% of the number of days in the complete courses taken. The full policy can be found online here: Return of Title IV Policy.

|